Trend two: More core activities are geing outsourced

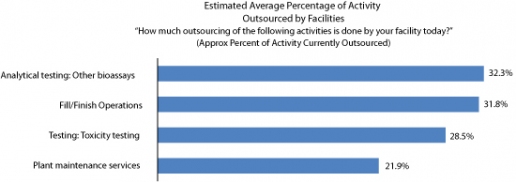

There is a growing trend towards outsourcing of activities previously deemed too core to be outsourced. In this latest survey, for example, 44.4% of respondents said that they outsourced downstream process development, a significant increase from 29.2% a year earlier and 22.1% in each of the prior two years.

Similarly, the proportion of respondents reporting having outsourced upstream process development has more than doubled since 2010, from 17.1% to 43.2%. Comparable rates of growth are also seen with outsourcing of design of experiments (from 21.4% to 43.2%) and quality-by-design (QbD) services (from 19.3% to 42%). These activities are still at the bottom of the list in terms of outsourcing popularity, but they are growing rapidly, signaling a greater degree of comfort on the part of clients with the technical expertise of their partners (see Figure 1).

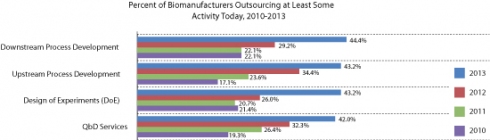

Trend three: Most outsourcing remains with lower-value activities

While the range of activities being outsourced is broadening into new areas, the heaviest levels of outsourcing activity are still centered on lower-value services.

From the responses gathered, BioPlan estimated the average percentage of outsourcing done by biomanufacturers across the various activities listed. On average, facilities outsource 32.3% of analytical testing/bioassays (up from 27.6% in 2012 year), 31.8% of their fill/finish operations (down from 34.5%), and 28.5% (27.3% in 2012) of their toxicity testing (see Figure 2). It’s worth remembering that these numbers are averaged out among all facilities including those not outsourcing any of these activities. In essence, it’s an estimate as to how much of the market’s activity in these areas is kept in-house as opposed to being outsourced.