Trend four: Majority of biosimilars production could be outsourced

One area that might end up being mostly outsourced is biosimilars production. Contract manufacturing organizations (CMOs) are likely to see big benefits from the advent of biosimilars, with many CMOs already reporting double-digit increases in business. Given that a significant portion of larger companies will likely prefer to allocate what in-house manufacturing capacity they have to newer, higher-margin products, it’s reasonable to foresee a scenario in which major players in biosimilars, at least from a marketing standpoint, will be using CMOs to manufacture their products. Companies will likely license biosimilars from a selection of small and foreign developers and then contract out the manufacturing of these products. It’s possible that a slim majority of biosimilars and biobetters will be manufactured by CMOs.

Trend five: Budgets for outsourcing are rebounding

The data and trends point to an outsourcing industry that is expanding in scope, but to what extent are budgets following? One would presume that biomanufacturers would be spending more on outsourcing given their increasing desire to contract out higher-value activities. And data does show that budgets for outsourcing have swung positive over the past few years, as the range of activities being outsourced has swelled.

In fact, over the past five years, respondents to BioPlan’s annual studies have gone from forecasting moderate decreases in spending (of -1.3% in 2009) on outsourced biopharmaceutical manufacturing to +1.7% budget increases in 2013. Only hiring of new operations and scientific staff has undergone a bigger turnaround in budgets during the past five years--with that swing very likely due to a general loosening of budgets after recessionary staff reductions.

Trend six: Outsourcing’s growing role in cost-containment

Outsourcing is no longer a top priority when facilities are looking to reduce costs. This may largely be due to saturation and limited returns, with the easiest attainable tasks and those offering the most savings from outsourcing likely already outsourced in prior years. It’s also another indication that outsourcing is moving to higher-value areas --with that calculus not driven by cost considerations but instead by the equipment and expertise that CMOs offer that may simply not be available in-house. In other words, use of CMOs is now, perhaps, viewed as a necessary unavoidable expense not affording opportunities or appropriate for further cost-saving. Rather than saving costs, CMOs are viewed as providing benefits including flexibility and low capital investment.

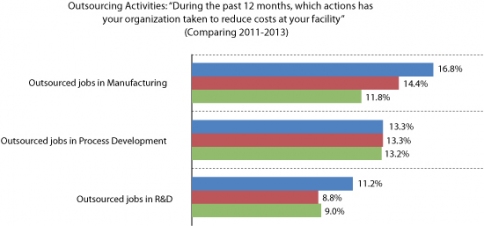

BioPlan asked organizations to identify which of several actions they had taken during the past 12 months to reduce costs at their facility (see Figure 3). The survey found 19 common actions associated with bioprocessing, and five of these were related to outsourcing. These five were near the bottom of the list. But it should be noted that they are growing. Last year, for example, 14% of respondents reported having outsourced manufacturing to domestic service providers to cut costs, while 12.6% offshored manufacturing as a cost-containment tool. Those percentages were roughly double the comparable figures from only to years earlier (7.1% and 5.7%, respectively).